nj property tax relief fund 2020

Beginning with tax year 2020 the Middle Class Tax Rebate will be issued to eligible New Jersey residents that file a 2020 resident Income Tax return NJ-1040 with a balance of tax 1 or more. To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019.

New York State Nys Property Tax H R Block

The main reasons behind the steep rates are high property values and education costs.

. County and municipal expenses. Increasing state aid is a very inefficient strategy to provide property tax relief for homeowners as a large share of state funding will end up increasing local spending or reducing business property taxes. Im proud to say that three of the five lowest property tax increase ever on.

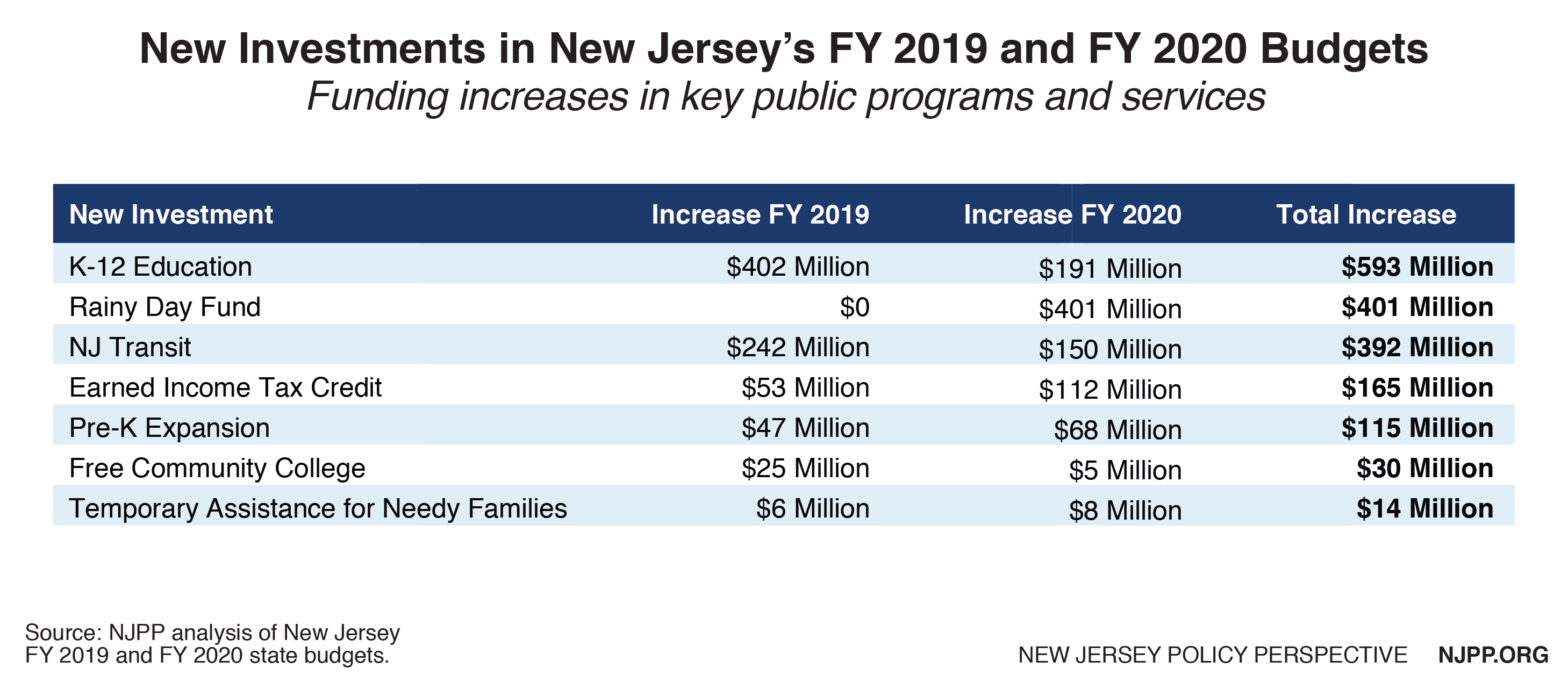

Capital gains on the sale of a principal residence of up to 250000 if single and up to 500000 if marriedcivil union couple. In New Jersey Murphy in recent years has billed his administrations push to better fund the state-aid formula for K-12 schools as a property-tax relief initiative. The rebates will be hitting the mail as soon as July 1 sending 500 to over 750000 New Jersey families.

Besides education property taxes in NJ also fund. Proceeds from spousescivil union partners life insurance. NJ Division of Taxation Senior Freeze Property Tax Reimbursement Inquiry.

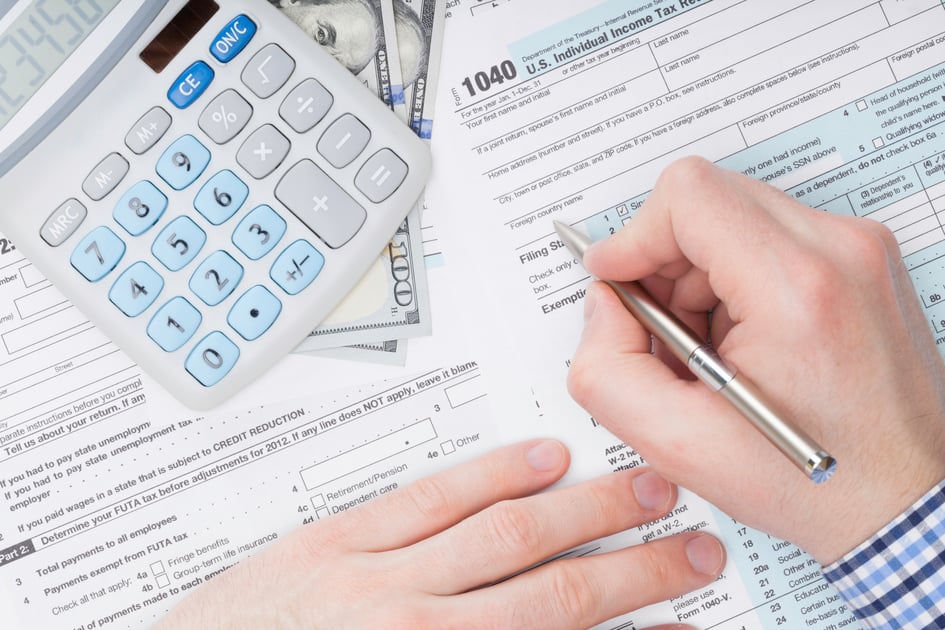

Beginning with tax year 2020 the Middle Class Tax Rebate will be issued to eligible New Jersey residents that file a 2020 resident Income Tax return NJ-1040 with a balance of tax 1 or more. 18 of your rent is used to calculate your share of property tax Per the state constitution Article VIII Section I paragraph 7 100 of personal income tax goes to property tax relief. Real estate Detail Property.

Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits. Renters can qualify for like 50 of property tax relief. The Garden State is home to the highest levies on property in the nation with a mean effective property tax rate of 221 according to the Tax Foundation.

While this growth is inflated because of the extended filing deadline collections are still below Treasurys 36 billion revised GIT target for July. Mortgage Relief Program is Giving 3708 Back to Homeowners. The Homestead credit is a popular property tax relief program for about 580000 seniors disabled or low-income homeowners.

Out of State Residents. 2021 Senior Freeze Applications. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018.

Check Your Eligibility Today. New Jersey Income Tax Author. Senior Freeze Property Tax Reimbursement Program.

Have a copy of your application available when you call. Nj Property Tax Relief Program Updates Access Wealth. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility.

In New Jersey localities can give. With questions call New Jerseys Senior Freeze Property Tax. All property tax relief program information provided here is based on current law and is subject to change.

Property 8 days ago Updated. Letter of Ineligibility for Out-of-State Residents Complete Request for a Letter of Property Tax Relief. 09 2020 5 New Jersey homeowners will not receive Homestead property tax credits on their Nov.

For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms. For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did. The Gross Income Tax GIT which is dedicated to the Property Tax Relief Fund totaled 3360 billion up 2412 billion or 2541 percent above last July.

Property Tax Reimbursement Hotline. 09 2020 605 pm. 1 real estate tax bills a state treasury.

Motor Fuels Tax revenues of 152 million fell 588 percent and Petroleum Products Gross Receipts Tax revenues of 609 million dropped by 574 percent compared to the same month last year. So any personal income tax refunds come out of the Property Tax Relief Fund. The deadline to file the application is October 31 2022.

The property tax relief programs are funded by state income tax payments. So any personal income tax refunds come out of the Property Tax Relief Fund. We will begin mailing 2021 applications in early March 2022.

Book A Consultation Today. Forms are sent out by the State in late Februaryearly March. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

Capital gains in excess of the allowable exclusion must be included in income. Homestead property tax relief not coming this year. Due to the fallout from the COVID pandemic Treasury reduced the FY 2020 revenue forecast by 27 billion as described in the May 22 Report to the Legislature.

Capital gains and the exclusion of all or part of the gain on the sale of. Phil Murphy wants to increase how much the state spends each year on property-tax relief benefits so more New Jersey residents can receive them.

Mississippi Property Tax H R Block

Taxes On Sale Of A Home In Texas What To Consider

Your Property Tax Break Could Come Back Under 3 5t Spending Bill Pushed By Senate Dems Nj Com

Free Income Tax Calculator Estimate Your Taxes Smartasset Income Tax Income Tax Return Federal Income Tax

Deducting Property Taxes H R Block

Kentucky Property Tax Calculator Smartasset

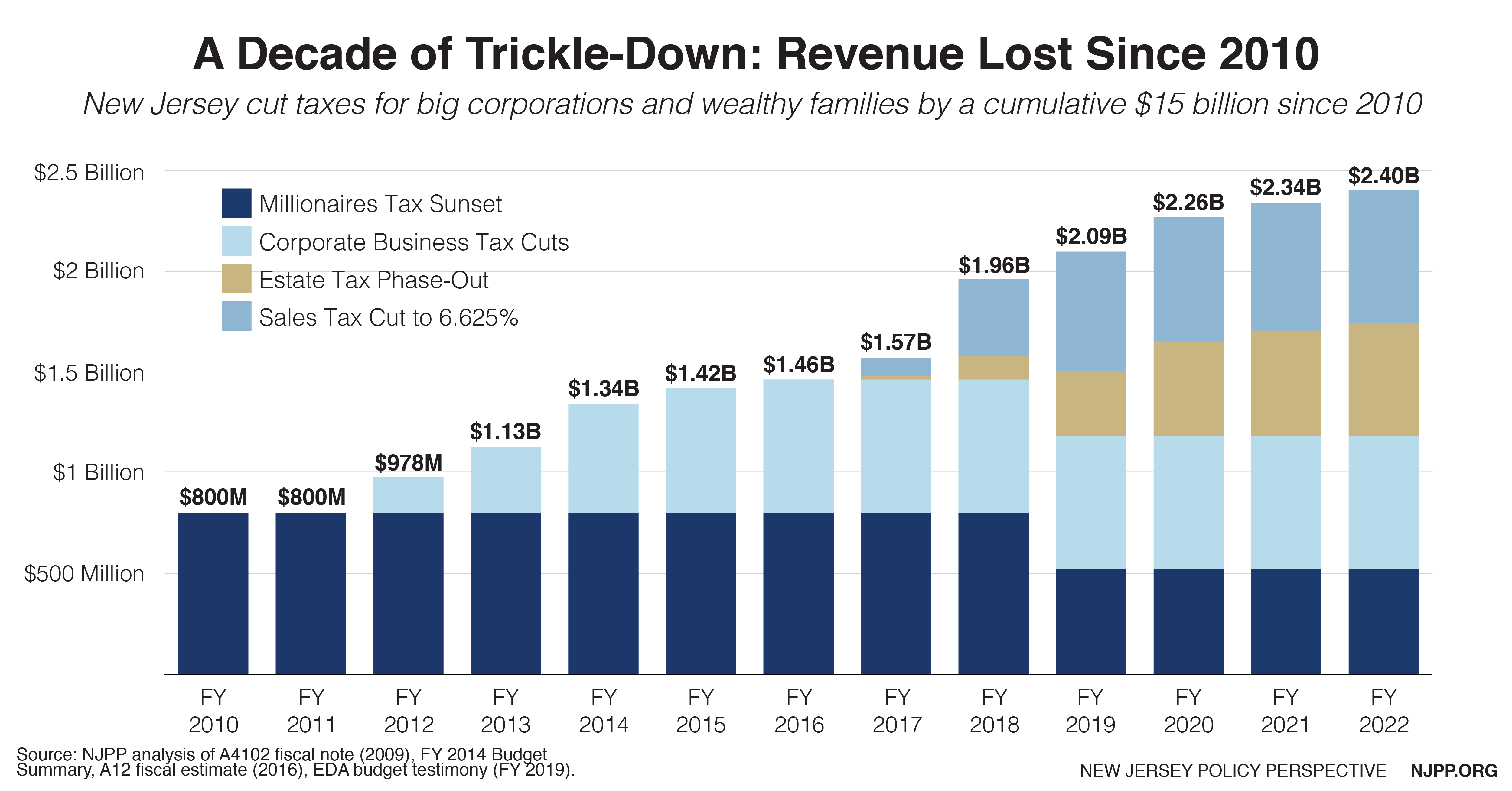

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

2020 2nd Quarter Property Taxes

Your 2020 Guide To Tax Deductions The Motley Fool

Louisiana La Property Tax H R Block

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

Alameda County Ca Property Tax Calculator Smartasset

Murphy S Property Tax Rebate Proposal Adds Renters Video Nj Spotlight News

The Official Website Of The Township Of Belleville Nj Tax Collector

Alabama Property Tax H R Block

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

How Is Tax Liability Calculated Common Tax Questions Answered